Michigan First Routing Number: Your Essential Guide for Success

Navigating your finances often requires precise information, and understanding your michigan first routing number is fundamental for seamless transactions. Whether you're setting up a direct deposit for your paycheck, initiating a secure wire transfer, or managing your accounts through online banking, this nine-digit code is crucial. This essential identifier facilitates Automated Clearing House (ACH) transactions, ensuring your funds reach their intended destination without delay or error. Having this information readily accessible empowers you to handle various financial operations efficiently.

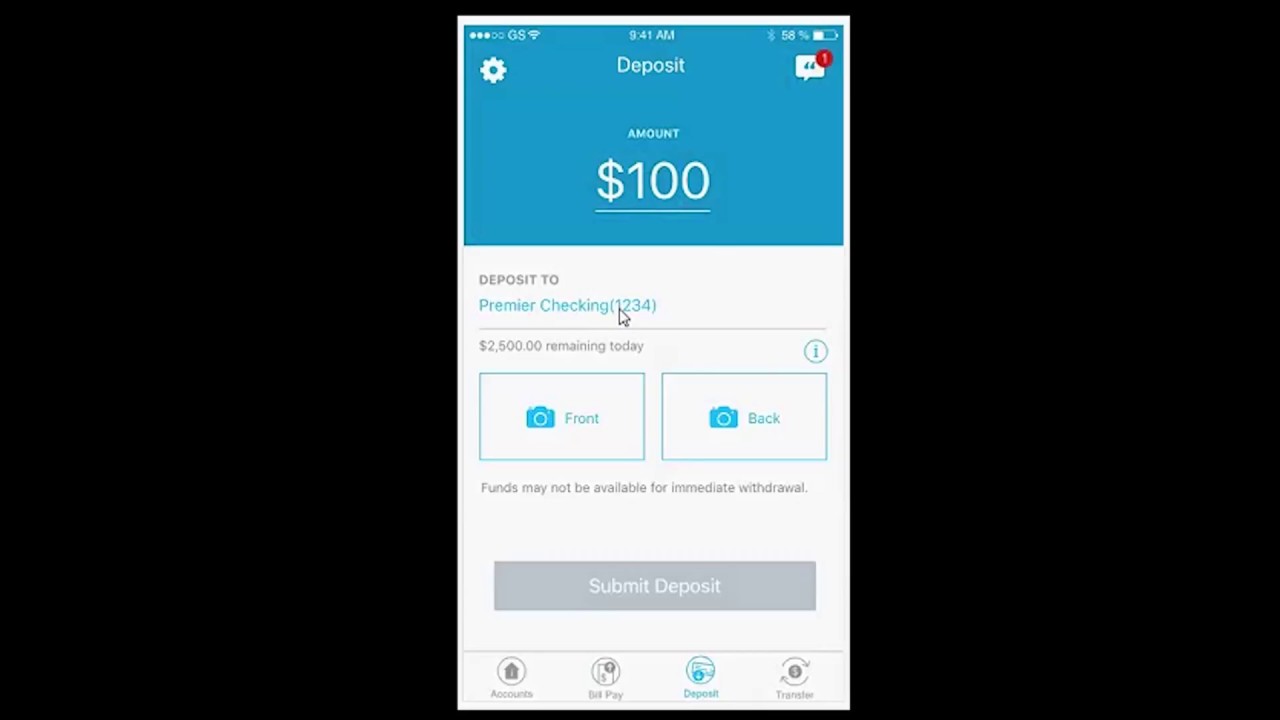

Image taken from the YouTube channel Michigan First Credit Union , from the video titled How to Deposit Your Checks with the Michigan First Mobile App - iPhone .

In today's fast-paced digital economy, managing your finances effectively hinges on understanding key banking identifiers. Among these, the routing number stands as a fundamental cornerstone, ensuring your money goes exactly where it's intended. This guide is designed to illuminate the crucial role of your specific Michigan First routing number, empowering you with the knowledge to conduct seamless financial transactions.

Understanding the Role of a Routing Number in Modern Banking

At its core, a routing number is a nine-digit code that acts like a unique address for your financial institution within the U.S. banking system. Also known as an ABA routing number (named after the American Bankers Association, which developed the system), it's essential for a vast array of electronic money transfers.

Without the correct routing number, financial transactions simply cannot be completed. It's the mechanism that directs funds to or from the appropriate bank or credit union, distinguishing it from thousands of other institutions. This identifier is critical for:

- Automated Clearing House (ACH) transactions: This includes everyday occurrences like direct deposits (paychecks, government benefits), automatic bill payments, and electronic fund transfers between accounts at different banks.

- Wire transfers: For sending larger sums of money quickly and securely, routing numbers are paramount.

- Check processing: The routing number is printed on the bottom of every check, allowing banks to identify where the funds should be drawn from.

Essentially, the routing number is the GPS coordinate for your bank, guaranteeing accuracy and security in the vast network of financial exchanges.

Why Your Specific Michigan First Routing Number Is Crucial for Seamless Financial Transactions

While every financial institution has a routing number, knowing your specific Michigan First routing number is vital. This unique code ensures that when you send or receive money, it correctly identifies Michigan First Credit Union as the destination or origin. Using an incorrect routing number, even by one digit, can lead to significant delays, rejections, or even misdirected funds, causing considerable inconvenience.

You'll need your Michigan First routing number for various essential transactions, including:

- Setting up direct deposit: Your employer will require it to deposit your paycheck directly into your Michigan First account.

- Configuring automatic bill payments: Many services require your routing number (along with your account number) to deduct payments automatically.

- Initiating wire transfers: Whether sending or receiving, the correct routing number is non-negotiable for secure wire transfers.

- Linking external bank accounts: If you use third-party apps or services to manage your finances, you’ll often need this number to connect your Michigan First account.

Using the correct routing number simplifies these processes, preventing potential headaches and ensuring your financial operations run smoothly.

Brief Overview of Michigan First Credit Union and Its Services

Michigan First Credit Union is one of the largest and most respected credit unions in Michigan, dedicated to serving its members with a comprehensive suite of financial products and services. Founded in 1926 as the Detroit Teachers Credit Union, it has grown significantly over the decades, now proudly serving over 190,000 members across the state.

As a member-owned, not-for-profit financial cooperative, Michigan First operates with a primary focus on its members' financial well-being. This commitment translates into:

- Competitive rates: Offering favorable interest rates on savings and loans compared to many traditional banks.

- Lower fees: Generally fewer and lower fees on services.

- Personalized service: A strong emphasis on community and tailored financial advice.

Michigan First provides a full range of banking services, including checking and savings accounts, certificates of deposit (CDs), mortgages, auto loans, personal loans, and a robust suite of online and mobile banking tools. Its mission is to empower members to achieve their financial goals through convenient access, innovative solutions, and trusted guidance.

Navigating the modern financial landscape often requires understanding the foundational elements that make banking secure and efficient. While the introduction highlighted the overall significance of routing numbers, truly appreciating their role begins with a clear understanding of what they are and how they operate.

What is a Routing Number? Unpacking the Basics

At its core, a routing number is a nine-digit code used to identify financial institutions within the United States. It's akin to a unique address for a bank or credit union, ensuring that electronic transactions are directed to the correct destination. Established by the American Bankers Association (ABA) in 1910, these numbers are a cornerstone of the national banking network, designed to facilitate the smooth and accurate flow of money.

Identifying Michigan First Credit Union

For members of Michigan First Credit Union, their routing number acts as a specific identifier that points directly to Michigan First within this vast financial system. Just as your account number identifies your individual account, the routing number tells the system which financial institution holds that account. This distinction is crucial because it ensures that when funds are sent to or from your Michigan First account, they are routed to the credit union itself, and not to another bank or financial institution. It’s the first step in ensuring your money reaches its intended home.

The Critical Role in Financial Transactions

The importance of a routing number cannot be overstated when it comes to various financial transactions. Without this vital nine-digit code, electronic transfers of money would be chaotic and prone to error. The routing number ensures accuracy and security by directing funds precisely where they need to go.

Consider some common scenarios:

- Direct Deposits: When your employer sends your paycheck via direct deposit, the routing number ensures that your funds are deposited into your account at Michigan First Credit Union.

- Automated Bill Payments: Setting up recurring bill payments? Your bank's routing number tells the biller where to pull the funds from.

- Wire Transfers: For larger or international transfers, the routing number is paramount for directing funds quickly and securely to the correct financial institution.

- Electronic Funds Transfers (EFTs): Any electronic movement of money, from person-to-person payments to online purchases, relies on the routing number to correctly identify the receiving or sending institution.

In essence, the routing number is a non-negotiable piece of information that underpins almost every electronic financial interaction, safeguarding your money and ensuring it arrives safely and efficiently at its destination.

Now that you have a clear grasp of what a routing number is and its fundamental role in securing your financial transactions, the next logical step is understanding how to easily locate yours. Knowing your Michigan First Credit Union routing number is essential for various banking activities. Fortunately, there are several straightforward ways to find it.

Discovering Your Michigan First Routing Number

Whether you're setting up a direct deposit, making an online payment, or initiating a wire transfer, having your Michigan First routing number readily available will save you time and ensure accuracy. Here's how you can find it.

Locating the Michigan First Routing Number on Your Checks

One of the most traditional and reliable places to find your routing number is directly on your Michigan First Credit Union checks.

Take a look at the bottom of any of your personal checks. You'll typically observe three sets of numbers printed using a special magnetic ink (known as the MICR line). The first set of nine digits, located on the far left, is your routing number. This is often followed by your account number and then the check number.

For Michigan First Credit Union, their primary routing number is consistently 272480036.

Finding Your Michigan First Routing Number Through Online Account Access

Michigan First Credit Union's online banking portal offers a convenient and secure method to access your routing number anytime, anywhere.

Simply log in to your Michigan First online account using your credentials. Once logged in, navigate to your "Account Details," "Direct Deposit Information," or a similar section dedicated to account summaries. Most financial institutions prominently display the routing number here for easy access, often alongside your account number. This method is particularly useful if you don't have a physical check handy.

Other Reliable Methods to Confirm Your Michigan First Routing Number

If checks aren't available or logging into online banking isn't feasible, don't worry. There are a couple of other dependable ways to confirm your Michigan First routing number:

- Michigan First Credit Union's Official Website: The quickest way to verify is often by visiting the official Michigan First Credit Union website. Their routing number is frequently published in a readily accessible area, such as a "Contact Us," "FAQ," or "About Us" section. Remember, the consistent routing number for Michigan First Credit Union is 272480036.

- Contact Customer Service: For direct assistance, you can always contact Michigan First Credit Union's customer service. You can typically reach them by phone at

[Michigan First Support Phone Number]or by sending a secure message through their online banking portal or email at[Michigan First Support Email]. Their representatives are equipped to provide you with the correct routing number and answer any related questions you may have.

After successfully locating your Michigan First Routing Number, it's essential to understand its critical role in various financial transactions. This seemingly small nine-digit code is fundamental for ensuring your money goes to or comes from the correct financial institution.

When You’ll Need Your Michigan First Routing Number

Your Michigan First Routing Number is far more than just a sequence of digits; it's a vital identifier that enables a wide array of financial operations, linking your specific account to the broader banking network. Understanding when and why you need it will streamline your financial management.

Setting Up Direct Deposit

One of the most common and convenient uses for your Michigan First Routing Number is when establishing direct deposit. Whether it's for your regular paycheck from an employer, government benefits like Social Security, or a tax refund, the routing number works alongside your account number to ensure funds are deposited directly and accurately into your Michigan First account. This eliminates the need for paper checks, offering both security and speed.

Managing Bill Pay

For seamless and timely financial obligations, your routing number is often required when setting up or managing bill pay. Many service providers, utility companies, or loan providers will ask for your bank's routing number to process automated or recurring payments directly from your account. This ensures that your bills are paid on time, helping you avoid late fees and maintain a good credit history.

Initiating or Receiving ACH Transactions

The Michigan First Routing Number is central to all ACH (Automated Clearing House) transactions. ACH is a robust electronic network used for a high volume of credit and debit transactions. This includes direct debits for things like mortgage payments, car loans, or insurance premiums, as well as direct credits such as refunds from online retailers or person-to-person payments. Your routing number ensures that these electronic transfers are directed to Michigan First Credit Union.

Performing Wire Transfer Operations

When you need to send or receive funds quickly, especially for larger amounts, wire transfers are often the preferred method. Unlike ACH transactions, wire transfers typically process in real-time and incur higher fees. For both incoming and outgoing wire transfers, your Michigan First Routing Number is absolutely essential. It tells the sending or receiving bank exactly which financial institution the funds need to be routed to, ensuring a secure and efficient transfer.

Understanding Its Role with Checks

Even in the digital age, checks remain a common financial tool. Your Michigan First Routing Number is prominently displayed on the bottom left of your checks. When you write a check, this number allows the recipient's bank to identify Michigan First Credit Union as the institution from which the funds will be drawn. Similarly, when you cash a check, the routing number on that check directs your bank where to collect the funds.

Other Common Financial Transactions

Beyond these primary uses, your Michigan First Routing Number may be required for various other financial transactions. This includes:

- Linking External Accounts: If you wish to link your Michigan First account to an external bank account, an investment platform, or a third-party payment app, the routing number will be necessary to establish the connection for transfers.

- Receiving Refunds: Businesses or government agencies often use ACH transfers, which require your routing number, to issue refunds directly to your bank account.

- Setting Up Electronic Funds Transfers (EFTs): Any recurring electronic transfer, whether between your own accounts at different institutions or to pay a service, will rely on your routing number for proper identification.

In essence, your Michigan First Routing Number acts as a critical identifier, ensuring that your funds are accurately and securely processed across the vast landscape of the financial system.

Having explored the various scenarios where your Michigan First Routing Number is essential, it’s equally important to understand what it is, and more crucially, how it differs from your personal account number. While both are vital for financial operations, they serve distinct purposes.

Understanding the Difference: Routing Number vs. Account Number

Navigating financial transactions often requires knowing specific numbers that identify your bank and your individual account. While often used in conjunction, your Michigan First Routing Number and your account number play entirely different, yet equally critical, roles in ensuring your money goes to the right place.

Clarifying Their Distinct Roles

Think of your financial institution as a large building with many individual apartments.

- Your Michigan First Routing Number acts like the building's street address. It’s a nine-digit code that uniquely identifies Michigan First Credit Union to other financial institutions within the U.S. financial system. Every transaction involving money moving into or out of Michigan First requires this "address" to direct the funds to the correct bank.

- Your Account Number, on the other hand, is like your specific apartment number within that building. This number is unique to your individual checking, savings, or other financial account at Michigan First. It tells the bank which specific account belongs to you, among the thousands of others they manage.

Why Both Are Indispensable for Financial Transactions

For almost any electronic financial transaction to be successful, both your Michigan First Routing Number and your individual account number are absolutely indispensable. They work in tandem to ensure accuracy and security.

When you set up direct deposit for your paycheck, for example, your employer uses the Michigan First Routing Number to send the funds to Michigan First Credit Union. Then, they use your unique account number to ensure those funds are credited specifically to your personal checking or savings account, and not someone else's. Similarly, when you pay bills online, both numbers are needed to confirm the payment originates from your specific account at Michigan First and goes to the intended recipient.

Potential Issues of Confusing Them

Mixing up your routing number and your account number can lead to significant problems and delays.

- Failed Transactions: If you provide your account number where the routing number is required, or vice versa, the transaction will likely fail. The system won't be able to properly identify either the bank or your specific account, leading to immediate rejection.

- Delayed Payments: Even if a transaction doesn't outright fail, incorrect numbers can cause processing delays. This is particularly problematic for time-sensitive payments like loan installments or utility bills, potentially leading to late fees or service interruptions.

- Funds Sent to the Wrong Place: In some unfortunate scenarios, if an incorrect number happens to match another valid account or bank, your funds could be misdirected. While financial institutions have safeguards, recovering funds sent to the wrong destination can be a lengthy and complicated process, causing significant stress and financial inconvenience. Always double-check these critical numbers to avoid such costly errors.

Having grasped the distinct roles of your Michigan First Routing Number and your individual account number, the next crucial step is to ensure these vital details are always used accurately and securely. Missteps can lead to more than just inconvenience; they can result in delayed transactions, misdirected funds, or even expose you to financial risk.

Ensuring Accuracy and Security in Your Financial Transactions

Accurate financial transactions and the robust security of your banking information are paramount. By adopting a few key practices, you can safeguard your Michigan First Credit Union accounts and ensure every transfer, payment, or deposit goes precisely where it's intended.

Best Practices for Verifying Your Details

Before initiating any financial transaction, taking a moment to verify your Michigan First Routing Number and account details can save significant headaches.

- Consult Reliable Sources: Always retrieve your routing and account numbers from official Michigan First Credit Union sources. These include your online banking portal, the Michigan First mobile app, your monthly account statements, or the bottom of your physical checks.

- Cross-Reference: If you're copying numbers, always cross-reference them with at least two different official sources. For instance, compare the numbers on your statement to those displayed in your online banking.

- Double-Check Every Digit: Human error is a common culprit. Before confirming any transaction, meticulously review every single digit of both the routing number and the account number. A single transposed digit can send funds to the wrong place or cause a transaction to fail.

Common Errors to Avoid in Financial Transactions

Understanding common pitfalls can help you steer clear of issues that might delay or misdirect your funds:

- Typographical Errors: Even one incorrect digit in either your routing or account number can lead to a transaction being rejected, returned, or, in rare cases, misdirected to another account.

- Confusing the Two Numbers: As discussed in the previous section, mixing up your routing number with your account number is a common mistake. Remember, the routing number identifies Michigan First, while your account number identifies your specific account within Michigan First.

- Using Outdated Information: If you've recently changed accounts or if an old account has been closed, ensure you are using the most current, active account information. Always discard or shred old checks and financial documents with outdated numbers.

- Not Confirming Payee Details: When sending money to someone else, confirm their banking details directly with them through a secure, alternative communication method (e.g., a phone call after an email request) to prevent "scams" where fraudsters impersonate a legitimate payee.

Protecting Your Financial Information

Your financial security extends beyond just accurate numbers. Protecting your information during all banking activities is crucial.

- Secure Online Access: Always use secure, private Wi-Fi networks when accessing your Michigan First online banking or mobile app. Avoid public Wi-Fi for sensitive transactions. Ensure your devices are protected with strong, unique passwords and consider enabling multi-factor authentication (MFA) if offered by Michigan First for an added layer of security.

- Beware of Phishing and Scams: Be vigilant against unsolicited emails, texts, or phone calls asking for your personal financial information. Michigan First Credit Union will never ask for your full account number, Social Security Number, or PIN via unprompted email or text. Always verify the sender's legitimacy.

- Monitor Your Accounts Regularly: Make a habit of reviewing your Michigan First account statements and transaction history at least once a month. Promptly report any suspicious or unauthorized activity to Michigan First Credit Union.

- Safeguard Documents: Physically shred any documents containing your account numbers, Social Security Number, or other sensitive financial information before discarding them. Secure your mail and be wary of unsolicited mail that looks like a financial statement or offer.

Video: Michigan First Routing Number: Your Essential Guide for Success

Frequently Asked Questions About Michigan First Routing Numbers

What is the Michigan First routing number?

The primary Michigan First routing number is 272483842. This nine-digit code uniquely identifies Michigan First Credit Union for financial transactions like electronic transfers and direct deposits.

Where can I find the Michigan First routing number?

You can easily locate the Michigan First routing number on the bottom of your checks. It's also available on Michigan First Credit Union's official website or by contacting their member service directly.

Why do I need the Michigan First routing number?

You need the Michigan First routing number for various essential financial activities. This includes setting up direct deposit for your paycheck, initiating electronic bill payments, sending or receiving wire transfers, and configuring automated clearing house (ACH) transactions.

Is the Michigan First routing number the same for all account types?

Typically, the main Michigan First routing number (272483842) applies to all standard checking and savings accounts. However, always verify for specific transaction types like international wire transfers, as instructions or intermediary bank codes might differ.

Keeping your michigan first routing number handy ensures all your financial dealings, from bill payments to receiving funds, remain smooth and trouble-free. It's a small piece of information that makes a big difference in your financial peace of mind.

Related Posts:

- Michigan Kids Left Alone: Legal Age? Avoid Common Parent Mistakes!

- The Mayor of Saginaw, Michigan: Leaders Shaping a City's Future

- Franklin Racquet Club Michigan: Unlock Your Best Racquet Sports!

- Is Michigan Ending Daylight Savings Time? Discover the Facts!

- The Truth About Weasel Michigan: Identify These Elusive Creatures!