Michigan Medicare Savings Program Application: Unlock Benefits Now!

Navigating Medicare costs can be challenging, especially for those on a fixed income. Fortunately, the Michigan Medicare Savings Program offers a vital pathway to significant financial relief. Understanding the medicare savings program application Michigan process is the crucial first step towards reducing healthcare expenditures. This essential program helps eligible individuals cover their Medicare Part B premiums, a substantial monthly expense. Additionally, for some, it can even assist with other cost-sharing elements like deductibles and copayments, depending on the specific program tier. Eligibility hinges on meeting certain income and resource limits. Local resources like the Michigan Medicare/Medicaid Assistance Program (MMAP) provide free, impartial counseling to guide beneficiaries through the application paperwork and answer any questions about the benefits available.

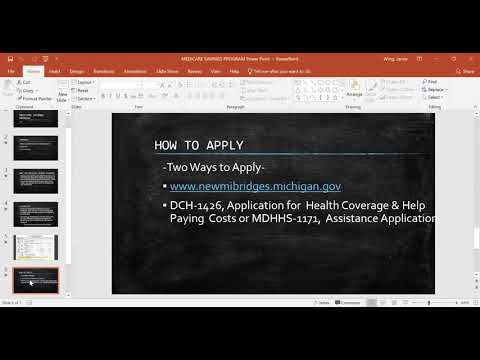

Image taken from the YouTube channel Disability Network Mid-Michigan , from the video titled Medicare Savings Program Webinar .

Navigating healthcare costs in retirement or with a disability can be a significant challenge, even with Medicare coverage. For many low-income individuals and families across the United States, managing Medicare premiums, deductibles, and co-pays can strain already tight budgets. This is where the Medicare Savings Program (MSP) comes into play, offering a vital financial lifeline.

What is the Medicare Savings Program (MSP)?

The Medicare Savings Program (MSP) is a set of federal programs administered by individual states, including Michigan, designed to help low-income Medicare beneficiaries pay for their Medicare costs. Essentially, it's a type of Medicaid program specifically tailored to assist those struggling to afford their Medicare expenses. Its primary purpose is to alleviate financial burdens, ensuring that eligible individuals can access the healthcare they need without sacrificing other essentials like food or housing.

MSP in Michigan: A Vital Financial Lifeline

For the more than 2 million Medicare beneficiaries in Michigan, the MSP can provide substantial relief. The program helps eligible residents manage various out-of-pocket Medicare costs that can otherwise become overwhelming. Depending on the specific MSP category an individual qualifies for (such as Qualified Medicare Beneficiary (QMB), Specified Low-Income Medicare Beneficiary (SLMB), or Qualifying Individual (QI)), the program can cover:

- Medicare Part B premiums: This is often the most significant and immediate benefit, as the state pays this monthly premium directly.

- Medicare Part A and Part B deductibles, co-insurance, and co-payments: For those qualifying under the QMB program, virtually all out-of-pocket Medicare costs are covered, providing comprehensive financial protection.

This direct financial assistance frees up funds that can be used for other critical living expenses, dramatically improving the quality of life for low-income seniors and individuals with disabilities in Michigan.

The Critical Importance of Applying for MSP

Despite the significant benefits, many eligible individuals in Michigan and across the country are unaware of the Medicare Savings Program or do not realize they qualify. Pursuing a Medicare Savings Program application in Michigan is not just about reducing your Medicare bills; it's about unlocking a broader array of essential benefits.

Crucially, approval for any MSP category automatically qualifies an individual for "Extra Help", also known as the Low-Income Subsidy (LIS). This federal program significantly reduces the costs associated with Medicare Part D prescription drug plans, including premiums, deductibles, and co-payments for medications. This dual benefit—assistance with traditional Medicare costs and prescription drug costs—makes the MSP an incredibly powerful tool for financial stability and access to healthcare. Taking the step to apply can lead to substantial savings and peace of mind.

Having understood the fundamental purpose of the Medicare Savings Program (MSP) and its vital role for low-income Michiganders, our next step is to explore the precise financial relief it provides. This section details how MSP directly alleviates the burden of out-of-pocket Medicare expenses, illustrating the specific benefits available to eligible individuals.

What the Medicare Savings Program (MSP) Covers

The Medicare Savings Program (MSP) serves as a critical financial lifeline, significantly reducing the healthcare costs for Medicare beneficiaries in Michigan. For those struggling to afford the various expenses associated with Medicare, MSP effectively bridges the gap, allowing individuals to access necessary medical care without facing prohibitive bills. By covering specific out-of-pocket costs, MSP ensures that beneficiaries can focus on their health rather than worrying about financial strain.

Specific Financial Assistance Provided by MSP

MSP provides targeted assistance with several key Medicare expenses, which can accumulate rapidly and pose a significant barrier to care. The exact benefits depend on the specific MSP program an individual qualifies for.

- Medicare Part B Premiums: This is often the most impactful benefit for many beneficiaries. Medicare Part B covers outpatient care, doctor visits, and preventive services, and typically involves a monthly premium. For 2024, the standard Part B premium is \$174.70. MSP can cover this entire amount, leading to substantial annual savings.

- Deductibles: A deductible is the amount you must pay out-of-pocket before Medicare begins to pay for your healthcare services. For example, in 2024, the Medicare Part B annual deductible is \$240. Certain MSPs can help cover this cost, ensuring beneficiaries don't have to pay it themselves.

- Co-insurance and Co-payments: These are your share of the cost for a Medicare-covered service. Co-insurance is a percentage of the cost (e.g., 20% for most Part B services), while a co-payment is a fixed amount. For eligible individuals, MSP can cover these costs, significantly reducing the financial burden of each doctor's visit or medical procedure.

Types of Medicare Savings Programs and Their Coverage in Michigan

Michigan offers the four federal Medicare Savings Programs, each designed to provide varying levels of support based on income and resource criteria. Understanding these distinct programs is key to recognizing the depth of coverage available.

Qualified Medicare Beneficiary (QMB) Program

The Qualified Medicare Beneficiary (QMB) Program offers the most comprehensive level of assistance. If you qualify for QMB, Michigan's Medicaid program will cover:

- Medicare Part A premiums (if applicable, as most beneficiaries receive premium-free Part A)

- Medicare Part B premiums

- Medicare deductibles for both Part A and Part B

- Medicare co-insurance and co-payments for both Part A and Part B services

This means that individuals enrolled in QMB generally have no out-of-pocket costs for Medicare-covered services.

Specified Low-Income Medicare Beneficiary (SLMB) Program

The Specified Low-Income Medicare Beneficiary (SLMB) Program provides a more focused benefit. For those who qualify for SLMB, Michigan's Medicaid program will pay for:

- Medicare Part B premiums only

This program is designed for individuals with slightly higher incomes than QMB, but still low enough to need assistance with the monthly Part B cost.

Qualifying Individual (QI) Program

The Qualifying Individual (QI) Program, sometimes referred to as QI-1, also helps with Medicare Part B premiums. Similar to SLMB, QI covers:

- Medicare Part B premiums only

The primary distinction between QI and SLMB lies in their income limits, with QI having slightly higher thresholds. It's important to note that the QI program has limited federal funding, meaning benefits are distributed on a first-come, first-served basis each year, even if an individual meets the eligibility criteria.

Qualified Disabled and Working Individuals (QDWI) Program

The Qualified Disabled and Working Individuals (QDWI) Program is specifically for certain disabled individuals under age 65 who returned to work, lost their premium-free Medicare Part A, and are no longer eligible for Medicaid. If you qualify for QDWI, Michigan's Medicaid program will pay for:

- Medicare Part A premiums only

This program helps these specific individuals maintain their hospital insurance coverage after re-entering the workforce.

By understanding the distinct benefits offered by each of these Medicare Savings Programs, Michigan residents can better assess how MSP can significantly reduce their healthcare expenditures, making essential medical care more accessible and affordable.

After exploring the valuable financial relief offered by the Medicare Savings Program, the next logical step is understanding who is eligible for these benefits. For Michigan residents, qualifying for MSP involves meeting specific criteria related to your enrollment in Medicare Part A, as well as adhering to federal income and asset limits that the state implements.

Eligibility Criteria for the Medicare Savings Program in Michigan

Understanding the eligibility requirements is a crucial step for anyone considering the Medicare Savings Program. This section will provide a detailed breakdown of the income and asset limits that Michigan residents must meet to qualify for MSP. We will also cover the essential requirement of being enrolled in Medicare Part A and clarify the intricate relationship between MSP, Medicare, and Medicaid for low-income individuals, including specific requirements based on federal guidelines.

Enrolling in Medicare Part A: A Prerequisite

A fundamental requirement for all Medicare Savings Programs is that you must be enrolled in Medicare Part A. Part A covers hospital insurance and is typically premium-free for most individuals who have worked and paid Medicare taxes for at least 10 years (40 quarters).

If you are not yet enrolled in Part A, you will need to do so to be considered for MSP benefits. Even if you have to pay a premium for Part A, certain MSPs, specifically the Qualified Disabled and Working Individuals (QDWI) program, can help cover that cost.

Michigan's Income and Asset Limits for MSP

Michigan follows federal guidelines for the Medicare Savings Program income and asset limits, which are updated annually. These limits are based on a percentage of the Federal Poverty Level (FPL) and are designed to assist those with limited financial resources.

It's important to note that when determining eligibility, certain types of income and assets are not counted. For instance, your primary home, one vehicle, household goods, personal effects, and typically up to $1,500 set aside for burial expenses per person are excluded from asset calculations. Additionally, a small disregard is often applied to your countable income.

Here are the general 2024 monthly income and asset limits for the various MSP programs in Michigan:

-

Qualified Medicare Beneficiary (QMB) Program:

- Income Limit: Up to $1,227 for an individual; $1,659 for a couple.

- Asset Limit: $9,910 for an individual; $14,860 for a couple.

- Benefits: Helps pay for Medicare Part A and Part B premiums, deductibles, coinsurance, and copayments.

-

Specified Low-Income Medicare Beneficiary (SLMB) Program:

- Income Limit: More than $1,227 up to $1,472 for an individual; more than $1,659 up to $1,992 for a couple.

- Asset Limit: $9,910 for an individual; $14,860 for a couple.

- Benefits: Helps pay for Medicare Part B premiums.

-

Qualifying Individual (QI) Program:

- Income Limit: More than $1,472 up to $1,659 for an individual; more than $1,992 up to $2,244 for a couple.

- Asset Limit: $9,910 for an individual; $14,860 for a couple.

- Benefits: Helps pay for Medicare Part B premiums. (This program has limited funding and is granted on a first-come, first-served basis.)

-

Qualified Disabled and Working Individuals (QDWI) Program:

- Income Limit: Up to $2,916 for an individual; $3,944 for a couple.

- Asset Limit: $4,000 for an individual; $6,000 for a couple.

- Benefits: Helps pay for Medicare Part A premiums for certain disabled individuals who are working and lost their premium-free Part A due to earnings.

It's crucial to remember that these figures are subject to change annually based on federal updates. Always verify the most current limits directly with the Michigan Department of Health and Human Services (MDHHS) or a Medicare/Medicaid assistance counselor.

The Interplay of MSP, Medicare, and Medicaid

For low-income individuals in Michigan, understanding the relationship between MSP, Medicare, and Medicaid can be complex but is vital.

- Medicare is a federal health insurance program primarily for people aged 65 or older, some younger people with disabilities, and people with End-Stage Renal Disease.

- Medicaid is a joint federal and state program that provides health coverage to millions of Americans, including eligible low-income adults, children, pregnant women, elderly adults, and people with disabilities.

The Medicare Savings Program serves as a bridge for Medicare beneficiaries who have limited income and assets but may not qualify for full Medicaid benefits. MSP helps cover Medicare-related costs, effectively reducing out-of-pocket expenses for those who have Medicare but still struggle with healthcare costs.

Dual Eligibility

If you qualify for full Medicaid benefits in Michigan, you will generally be automatically eligible for a Medicare Savings Program, often the QMB program. This is because Medicaid's income and asset limits are typically lower or similar to MSP, meaning if you meet Medicaid's more stringent criteria, you also meet MSP's. Individuals who qualify for both Medicare and Medicaid are known as "dual-eligible beneficiaries." In these cases, Medicaid works in conjunction with Medicare, picking up costs that Medicare doesn't cover, including premiums, deductibles, and coinsurance, often eliminating the need for a separate MSP application.

For those whose income is too high for full Medicaid but still falls within the MSP limits, MSP provides critical assistance without granting full Medicaid health coverage. This distinction is important: MSP helps with Medicare costs, whereas Medicaid provides comprehensive health coverage on its own terms.

After establishing whether you meet the eligibility criteria for the Medicare Savings Program (MSP) in Michigan, the next crucial step is to understand and navigate the application process. This can seem daunting, but with a clear roadmap and the right information, it becomes a manageable journey.

Navigating the Medicare Savings Program Application Process in Michigan

This section is designed to demystify the application process for the Medicare Savings Program in Michigan. We will provide a step-by-step guide on how to initiate and complete your application, identifying the Michigan Department of Health and Human Services (MDHHS) as the primary authority. Crucially, we will outline all the required documentation, including proof of income, assets, and Medicare enrollment, and offer practical tips for ensuring a smooth and efficient application process through MDHHS.

The Michigan Department of Health and Human Services (MDHHS)

The Michigan Department of Health and Human Services (MDHHS) is the primary authority responsible for administering and processing applications for the Medicare Savings Program in Michigan. MDHHS oversees a wide array of assistance programs, including MSP, ensuring that residents can access the support they need. Understanding their role is key to a successful application.

Your Step-by-Step Guide to Applying for MSP in Michigan

Applying for the Medicare Savings Program in Michigan involves a few key steps to ensure your application is complete and processed efficiently:

- Gather Information and Prepare: Before starting, ensure you have a clear understanding of the MSP types (QMB, SLMB, QI, QDWI) and the specific eligibility criteria, as discussed in the previous section.

- Choose Your Application Method: MDHHS offers several convenient ways to apply:

- Online: The most common and often quickest method is through MI Bridges, the MDHHS online portal. Visit newmibridges.michigan.gov to create an account and complete your application digitally. This platform allows you to upload documents directly.

- By Phone: You can call the MDHHS customer service line (typically 1-844-315-3736 for MI Bridges support, or check the MDHHS website for direct assistance numbers) to apply over the phone or to get assistance with your application.

- In Person: Visit your local MDHHS office to apply with the help of a caseworker. You can find your nearest office by searching the MDHHS website. This option is helpful if you prefer face-to-face assistance or need help with documentation.

- By Mail: Download the application form from the MDHHS website, complete it, and mail it with your supporting documents to the address provided on the form or to your local MDHHS office.

- Complete the Application Form: Fill out all sections of the application accurately and completely. Provide truthful information about your income, assets, household composition, and Medicare status.

- Submit Required Documentation: As outlined in the next section, you will need to provide various documents to verify the information on your application. Ensure all copies are clear and legible.

- Attend an Interview (If Required): MDHHS may require an interview, either in person or over the phone, to clarify information or discuss your application in more detail.

- Follow Up: After submitting your application, it's a good practice to follow up with MDHHS if you don't hear back within a reasonable timeframe. You can often check the status of your application through MI Bridges.

Essential Documents for Your MSP Application

To ensure a smooth application process for the Medicare Savings Program, it is crucial to prepare and submit all the necessary documentation. These documents help MDHHS verify your eligibility based on federal and state guidelines. Expect to provide proof of the following:

- Proof of Identity: A valid Michigan driver's license, state ID, or other government-issued identification.

- Proof of Residency: A utility bill, lease agreement, or mail with your current Michigan address.

- Proof of Medicare Enrollment: Your Medicare card, showing your Part A effective date and Medicare claim number.

- Proof of Income: This is vital. You will need recent documentation for all sources of income for every household member applying. This may include:

- Recent pay stubs (for employment income).

- Social Security benefit statements (e.g., SSA-1099, award letter).

- Pension statements.

- Veterans' benefits statements.

- Tax returns (if self-employed or for certain income types).

- Unemployment benefits statements.

- Statements for any other regular income.

- Proof of Assets/Resources: Documentation demonstrating the value of your countable assets, which could include:

- Recent bank statements (checking, savings accounts).

- Statements for stocks, bonds, mutual funds, or other investments.

- Proof of other liquid assets. (Note: Your primary residence, one vehicle, and personal belongings are typically exempt).

- Social Security Numbers (SSNs): For all household members applying for assistance.

Always provide copies, not original documents, unless specifically requested by MDHHS.

Tips for a Seamless Application Experience

To facilitate an efficient and successful application process for the Medicare Savings Program through MDHHS, consider these practical tips:

- Organize Your Documents: Before you begin, gather all required documents and make clear copies. Having everything organized will save you time and reduce stress.

- Be Thorough and Accurate: Double-check that all information on your application is correct and complete. Errors or omissions can lead to delays.

- Be Honest: Provide truthful information about your income, assets, and household situation. Misrepresenting facts can have serious consequences.

- Keep Copies: Always keep a copy of your submitted application and all accompanying documents for your records. This is invaluable if questions arise later.

- Ask Questions: If you are unsure about any part of the application or what documents are needed, do not hesitate to ask. Contact MDHHS directly, visit a local office, or utilize the MI Bridges help resources.

- Respond Promptly: If MDHHS requests additional information or an interview, respond as quickly as possible. Delays on your part can prolong the application review.

- Utilize MI Bridges: If comfortable with technology, applying through MI Bridges can be highly efficient. It allows you to track your application status, upload documents, and communicate with your caseworker online.

By following these steps and tips, you can navigate the Medicare Savings Program application process in Michigan with greater confidence, bringing you closer to receiving valuable assistance with your Medicare costs.

Having successfully navigated the application process for the Medicare Savings Program in Michigan, it's equally important to understand how other crucial healthcare programs can work in tandem with your MSP benefits. This comprehensive approach ensures you maximize your coverage and minimize out-of-pocket expenses.

Understanding Related Programs: Extra Help Program and Medicaid

Beyond the Medicare Savings Program, it's beneficial to understand how other vital programs can complement your healthcare coverage. This section offers a brief explanation of the Extra Help Program, which assists with prescription drug costs, and its connection to MSP. We will also clarify how qualifying for Medicaid in Michigan may automatically grant eligibility for certain Medicare Savings Program benefits, illustrating how MSP can work in conjunction with Medicaid for low-income individuals in the state.

The Extra Help Program: Alleviating Prescription Drug Costs

The Extra Help Program, also known as the Low-Income Subsidy (LIS), is a federal program designed to assist Medicare beneficiaries with limited income and resources in paying for their Medicare Part D prescription drug costs. This includes help with monthly premiums, annual deductibles, and prescription co-payments or co-insurance.

There's a significant connection between Extra Help and the Medicare Savings Programs:

- Automatic Qualification: If you qualify for certain Medicare Savings Programs—specifically the Qualified Medicare Beneficiary (QMB) program, the Specified Low-Income Medicare Beneficiary (SLMB) program, or the Qualifying Individual (QI) program—you will automatically qualify for Extra Help from Medicare. This means you do not need to submit a separate application to the Social Security Administration (SSA) for Extra Help; your MSP eligibility will grant it.

- Streamlined Benefits: For those who qualify, Extra Help can dramatically reduce the cost of prescription medications, making essential drugs more affordable. It works seamlessly with your Medicare Part D plan to cover these expenses.

While the Social Security Administration oversees the Extra Help Program, understanding its direct link to MSP can help you secure comprehensive support for both medical and prescription drug expenses.

Medicaid and Automatic MSP Eligibility in Michigan

Medicaid is a joint federal and state program that provides comprehensive health coverage to low-income individuals and families. In Michigan, this program is administered by the Michigan Department of Health and Human Services (MDHHS).

A crucial point for Medicare beneficiaries in Michigan is the strong connection between Medicaid and the Medicare Savings Programs:

- Automatic QMB Enrollment: If you are a Michigan resident and qualify for full Medicaid benefits, you generally automatically qualify for the Qualified Medicare Beneficiary (QMB) program, one of the most comprehensive Medicare Savings Programs.

- Broad Coverage: Under the QMB program, the state pays for your Medicare Part A and Part B premiums, deductibles, co-payments, and co-insurance. This means that if you have full Medicaid and QMB, most of your Medicare-related medical costs will be covered. This significantly reduces your out-of-pocket expenses for services covered by Medicare.

This automatic eligibility streamlines the process for many low-income individuals who are already receiving Medicaid assistance, ensuring they also benefit from the substantial savings offered by MSP without additional application hurdles.

How MSP Complements Medicaid for Dual-Eligible Individuals

For low-income individuals in Michigan who are eligible for both Medicare and Medicaid (often referred to as "dual-eligible"), the Medicare Savings Program plays a vital complementary role:

- Filling Medicare Gaps: While Medicaid provides extensive health coverage, it generally doesn't cover Medicare Part A and Part B premiums, deductibles, co-payments, or co-insurance for Medicare-covered services. This is precisely where MSPs, particularly QMB, step in. By paying these Medicare-related costs, MSP ensures that Medicare beneficiaries on Medicaid have virtually no out-of-pocket expenses for services Medicare covers.

- Comprehensive Care: This combination ensures a more complete healthcare safety net. Medicare acts as the primary payer for Medicare-covered services, with MSP handling the cost-sharing responsibilities, and then Medicaid steps in as the payer of last resort, covering services that Medicare might not, such as long-term care or additional dental and vision benefits, depending on the state's Medicaid plan.

- Financial Relief: For those with limited financial resources, this dual enrollment provides immense financial relief, making healthcare accessible and affordable without the burden of high premiums, deductibles, or co-pays. It ensures that essential medical care is not forgone due to cost.

While understanding programs like Extra Help and Medicaid helps clarify how the Medicare Savings Program fits into your overall healthcare strategy, the next crucial step is often finding the right support to navigate the application process itself. Fortunately, Michigan offers several key resources to assist you.

Where to Find Assistance with Your Michigan Medicare Savings Program Application

Navigating government programs can sometimes be daunting, but help is readily available. This section highlights key resources in Michigan dedicated to assisting with your Medicare Savings Program application. We will detail the vital role of the Michigan Department of Health and Human Services (MDHHS) in providing information and accepting applications, and emphasize the value of utilizing the State Health Insurance Assistance Program (SHIP) for free, personalized counseling. Additionally, we'll point to other local resources and support networks available to low-income individuals seeking help with Medicare and MSP.

Michigan Department of Health and Human Services (MDHHS)

The Michigan Department of Health and Human Services (MDHHS) serves as a cornerstone for accessing state-administered benefits, including the Medicare Savings Programs. MDHHS is the primary agency responsible for processing applications and determining eligibility for MSP, largely because eligibility criteria often align with those for Medicaid and other state assistance programs.

You can apply for Medicare Savings Programs directly through MDHHS. This can typically be done online via the MI Bridges portal, which is Michigan's public assistance benefits application system. MI Bridges allows you to apply for multiple programs simultaneously, track your application status, and manage your benefits. Alternatively, you can apply in person at a local MDHHS office or submit a paper application. MDHHS also provides comprehensive information on their website regarding eligibility requirements and the necessary documentation for a successful application.

Michigan Medicare/Medicaid Assistance Program (MMAP) – Your State SHIP

One of the most valuable resources available for personalized, unbiased assistance is the Michigan Medicare/Medicaid Assistance Program (MMAP). MMAP is Michigan's official State Health Insurance Assistance Program (SHIP), funded by the federal government to provide free, confidential, and unbiased counseling on Medicare-related issues.

MMAP certified counselors, often volunteers, are trained to:

- Explain Medicare benefits and options.

- Help you understand how MSP works and who qualifies.

- Assist you with the Medicare Savings Program application process, ensuring all necessary forms are completed accurately.

- Provide guidance on other programs like Extra Help for prescription costs.

Utilizing MMAP is highly recommended as their services are entirely free and designed to simplify complex Medicare decisions. You can reach MMAP by calling 1-800-803-7174 or by visiting their website at Michigan.gov/MMAP to find local counseling sites or request assistance.

Other Local Resources and Support Networks

Beyond MDHHS and MMAP, several other local organizations and support networks offer assistance to low-income individuals seeking help with Medicare and Medicare Savings Programs:

- Area Agencies on Aging (AAAs): These agencies serve seniors and caregivers in specific geographic regions. Many AAAs provide information and referrals for Medicare, Medicaid, and MSP, and can often connect you with local services that offer application assistance.

- Community Action Agencies (CAAs): Located throughout Michigan, CAAs are non-profit organizations dedicated to helping low-income individuals and families achieve self-sufficiency. They often have specialists who can provide guidance on various benefit programs, including MSP, and assist with the application process.

- Local Senior Centers: Many senior centers offer workshops, one-on-one counseling, or referrals to resources that can help with Medicare and MSP applications. They serve as valuable community hubs for older adults.

- Non-profit Organizations: Various local non-profits focused on elder care, poverty alleviation, or health advocacy may offer direct assistance or connect you with pro bono legal aid or financial counselors who can help navigate government benefits.

When seeking help, it's always advisable to confirm that the organization offers free assistance and that their counselors are certified or highly knowledgeable in Medicare and state benefit programs.

Video: Michigan Medicare Savings Program Application: Unlock Benefits Now!

Frequently Asked Questions About the Michigan Medicare Savings Program

What is the Michigan Medicare Savings Program?

The Michigan Medicare Savings Program (MSP) is a state-administered program that helps low-income Medicare beneficiaries pay for Medicare premiums, deductibles, coinsurance, and copayments. It can significantly reduce your out-of-pocket healthcare costs.

Who is eligible for the Michigan Medicare Savings Program?

Eligibility for the Michigan Medicare Savings Program is based on specific income and asset limits set by federal guidelines, which vary by the type of MSP (QMB, SLMB, QI). These limits are updated annually, so it's important to check current requirements.

How do I apply for the Medicare Savings Program in Michigan?

You can apply for the Medicare Savings Program in Michigan through your local Michigan Department of Health and Human Services (MDHHS) office. The medicare savings program application michigan form can be obtained there or often found online, requiring documentation of income and assets.

What benefits can I expect from the Michigan Medicare Savings Program?

Depending on the specific program you qualify for, benefits can include full payment of your Medicare Part B premium, assistance with Part A premiums (if applicable), and help with deductibles and copayments. This leads to substantial savings on healthcare expenses.

Taking the initiative to complete your medicare savings program application Michigan can lead to significant financial peace of mind. Don't miss out on these valuable benefits – explore your eligibility today!

Related Posts:

- Wyandotte Michigan Map: Unlock Hidden Gems, Navigate Like a Pro!

- Discover Rare Lake Michigan Agate: Your Ultimate ID & Find Guide!

- Midges in Michigan: End the Bite! Ultimate Guide to Swarm Control

- Lending Hands of Michigan Inc.: Discover How They Transform Michigan!

- Napoleon Bee Supply Michigan: Uncover Gold in Local Beekeeping!