Michigan Paycheck Calc: Get Yours Right the First Time!

Navigating payroll complexities in Michigan requires understanding federal income tax withholding, which significantly impacts your take-home pay. The Michigan Department of Treasury provides resources to help employees understand state income tax obligations, a critical component for accurate calculations. Employing a reliable michigan paycheck calc ensures precise deductions for both Medicare and Social Security taxes are factored in. Furthermore, familiarizing yourself with services offered by companies like ADP allows you to estimate your net pay and understand the impact of various deductions.

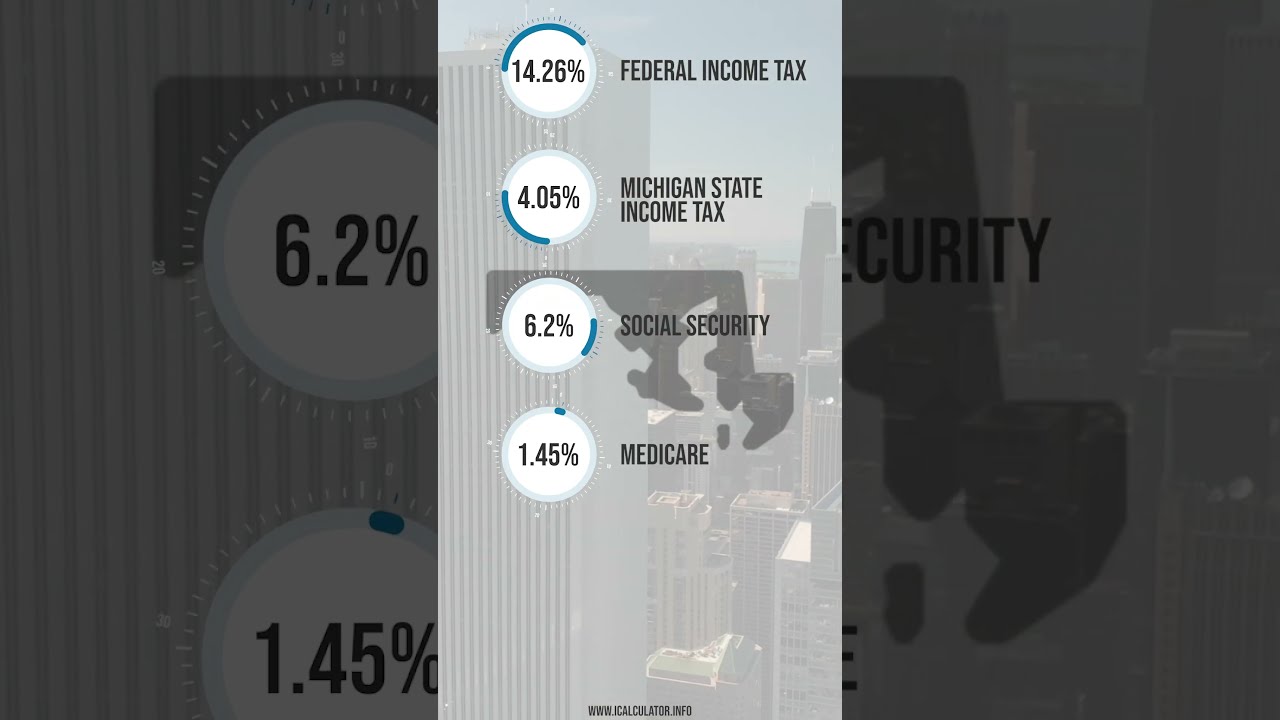

Image taken from the YouTube channel Business Finance Coach , from the video titled How to calculate payroll? How are taxes calculated on a paycheck? What are payroll taxes? .

Optimizing Your "Michigan Paycheck Calc: Get Yours Right the First Time!" Article Layout

The key to a successful article about a Michigan paycheck calculator, optimized for the keyword "michigan paycheck calc," is providing clear, accurate, and actionable information. The layout should prioritize user experience, enabling readers to quickly find the information they need to accurately calculate their paycheck. Here's a suggested article structure:

Understanding Your Michigan Paycheck

The initial section should lay the groundwork for using a Michigan paycheck calculator. It should explain the components of a paycheck and how they relate to taxes and deductions.

Gross Pay vs. Net Pay

- Gross Pay: Define gross pay as the total amount earned before any deductions.

- Net Pay: Explain that net pay is the "take-home" pay, calculated after all taxes and deductions are subtracted.

- Emphasize the importance of understanding the difference to avoid budgeting errors.

Key Paycheck Components

- Federal Income Tax: Explain that federal income tax is withheld based on information provided on Form W-4.

- Social Security and Medicare Taxes (FICA): Outline the FICA tax rates for both Social Security and Medicare. Use percentages for clarity.

- Michigan State Income Tax: Detail the current Michigan state income tax rate.

- Local Taxes (if applicable): Mention that some Michigan cities may have local income taxes and direct readers to find out if this applies to them.

- Pre-Tax Deductions: Briefly explain common pre-tax deductions like health insurance premiums, 401(k) contributions, and HSA contributions.

- Post-Tax Deductions: Briefly explain common post-tax deductions like union dues or charitable contributions.

Using a Michigan Paycheck Calculator Effectively

This section provides step-by-step instructions on using a "michigan paycheck calc" to calculate net pay.

Gathering Necessary Information

Provide a checklist of the information needed to use the calculator.

- W-4 Form: Explain that the W-4 form provides information about filing status, dependents, and other factors that affect federal income tax withholding.

- Pay Stub: Encourage users to refer to their most recent pay stub for accurate deduction amounts.

- Salary Information: Specify if the salary is hourly, bi-weekly, monthly, or annually, and the corresponding pay rate/amount.

Step-by-Step Calculation Guide

Provide detailed, sequential instructions. Use numbered lists for optimal clarity.

- Access the Calculator: Provide a direct link to a recommended "michigan paycheck calc" tool (if permissible; otherwise, instruct users on how to find one online).

- Enter Gross Pay: Instruct users to input their gross pay amount and select the appropriate pay frequency (e.g., bi-weekly, monthly).

- Enter W-4 Information: Guide users through the sections of the W-4 form that affect tax withholdings and explain how to enter this information into the calculator.

- Input Deductions: Instruct users on how to enter pre-tax and post-tax deductions accurately. Explain the difference and why it matters.

- Calculate and Review: Explain how to initiate the calculation and review the results. Emphasize the importance of verifying the calculations.

- Address Discrepancies: Suggest steps to take if the calculator's estimate differs significantly from their actual paycheck.

Examples and Scenarios

Provide a couple of hypothetical scenarios and demonstrate how to use the calculator in each instance.

- Example 1: Salaried Employee: A single individual with no dependents and standard deductions.

- Example 2: Hourly Employee: A married individual with dependents and pre-tax contributions to a 401(k).

Use tables to present the input values and the resulting calculated values for each example. This will demonstrate how different inputs impact the final net pay.

Michigan State Taxes: A Deeper Dive

Expand on the Michigan-specific tax implications.

Michigan State Income Tax Details

- Reiterate the current Michigan state income tax rate.

- Explain if there are any tax credits or deductions specific to Michigan residents that can be claimed. (Direct to official Michigan Department of Treasury resources for up-to-date information.)

Local Taxes in Michigan

- Reiterate that local income taxes may apply in some Michigan cities. Provide examples of cities that typically have local taxes.

- Provide links to resources where readers can find information about local tax rates for their specific city or municipality.

Resources and Further Information

Provide links to helpful resources.

Official Government Websites

- Internal Revenue Service (IRS): Link to the IRS website for information on federal income taxes.

- Michigan Department of Treasury: Link to the Michigan Department of Treasury website for information on Michigan state income taxes.

Other Helpful Resources

- Links to reputable financial websites or articles that provide further information on paycheck calculations and tax planning.

Video: Michigan Paycheck Calc: Get Yours Right the First Time!

Michigan Paycheck Calc: Frequently Asked Questions

Still have questions about calculating your Michigan paycheck? Here are some common inquiries to help you get it right the first time.

What taxes affect my Michigan paycheck?

Your Michigan paycheck is subject to federal income tax, Social Security tax, Medicare tax, and potentially Michigan state income tax. The amount withheld depends on your W-4 form and any exemptions you claim. A michigan paycheck calc helps you estimate these withholdings.

How does the Michigan state income tax work?

Michigan has a flat income tax rate. Your employer will withhold this amount from your paycheck based on the information you provide on your MI-W4 form. Using a michigan paycheck calc can simplify this withholding calculation.

What happens if I don't fill out my W-4 correctly?

If you don't fill out your W-4 or MI-W4 forms correctly, you could have too much or too little tax withheld from your paychecks. This could lead to owing taxes or receiving a smaller refund when you file your taxes. Accuracy is key when setting up a michigan paycheck calc for your own situation.

Are there any deductions I should consider when using a Michigan paycheck calc?

Yes, consider pre-tax deductions like health insurance premiums, retirement contributions (401k), and HSA contributions. These deductions reduce your taxable income, resulting in lower taxes withheld from your michigan paycheck. Be sure to factor those in when estimating your take-home pay.

Related Posts:

- Grand Rapids Camping: Your Ultimate Guide to Michigan's Outdoors!

- Ace Your Michigan CDL Test: Proven Practice Tips & Resources!

- Michigan Bird Identification: Your Ultimate Guide to Spotting Birds

- The #1 Michigan Sticker Guide: Show Your Ultimate Mitten Love

- Lake Sanford's Rebirth: Your Complete 2024 Visitor's Guide!