Maximize Your Michigan Salary After Taxes: Secrets Revealed!

Understanding salary after taxes Michigan requires navigating a complex landscape, starting with the Michigan Department of Treasury. Their regulations directly impact how income is taxed. A crucial element in calculating this is the federal income tax, a deduction that significantly influences your take-home pay. Furthermore, the type of employment you have, from W-2 employee to independent contractor, will determine your tax responsibilities. Finally, utilizing a reliable tax calculator is essential for accurate projections. This article unveils secrets to maximize your salary after taxes Michigan by exploring these key areas and providing actionable strategies.

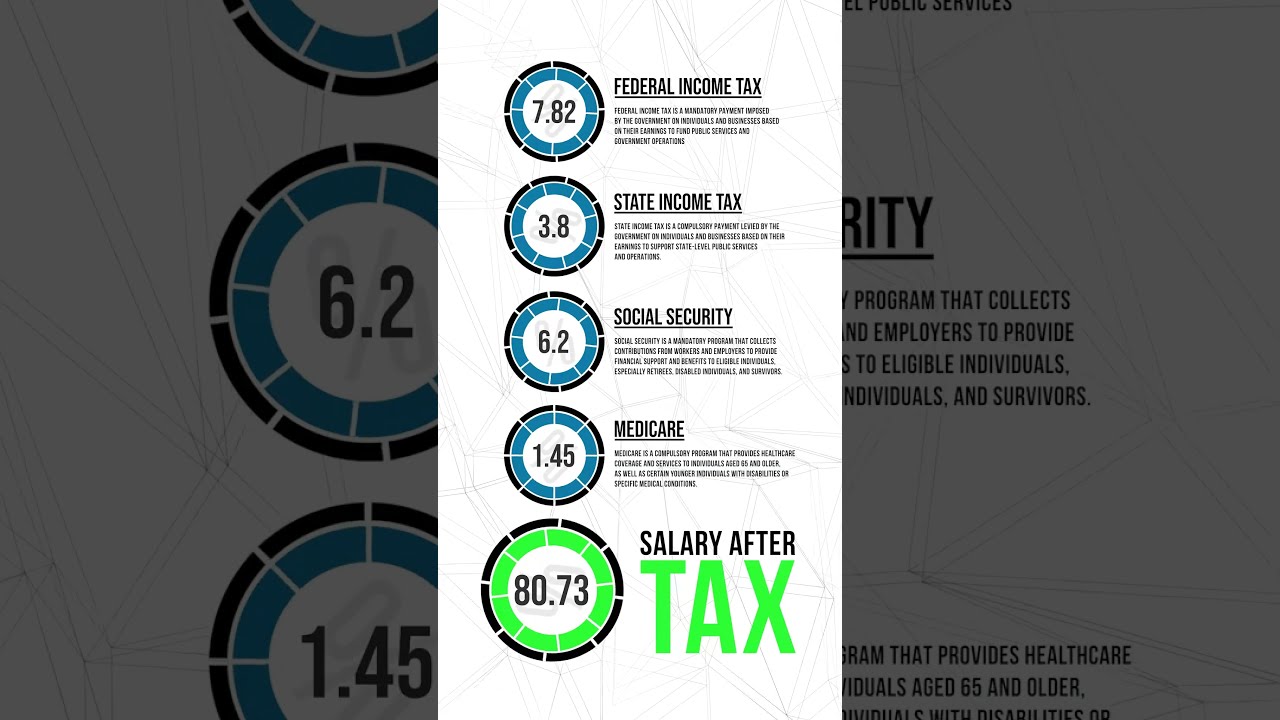

Image taken from the YouTube channel iCalculator , from the video titled $40,000 Salary After Tax in Michigan: Detailed Annual Tax Breakdown | 2023 .

Optimizing Your Post-Tax Income in Michigan: A Comprehensive Guide

This guide breaks down how to maximize your "salary after taxes Michigan." It covers various deductions, credits, and financial strategies to help you retain more of your earnings. We will analyze key aspects of Michigan's tax system and explore actionable steps you can take to improve your financial situation.

Understanding Michigan's Tax Landscape

Before optimizing, you need a clear understanding of the tax liabilities affecting your "salary after taxes Michigan." This involves recognizing both federal and state taxes.

Federal Income Tax

This is the first deduction from your paycheck. Your employer withholds federal income tax based on the W-4 form you submitted. Understand your filing status (single, married filing jointly, etc.) and claim dependents appropriately on your W-4 to ensure accurate withholding. If you anticipate itemizing deductions, consider adjusting your W-4 to increase your withholding throughout the year and avoid underpayment penalties.

Social Security and Medicare Taxes (FICA)

These are mandatory payroll taxes. Social Security tax is a percentage of your wages, up to a certain annual limit (determined each year by the Social Security Administration). Medicare tax applies to all wages without a limit.

Michigan State Income Tax

Michigan has a flat income tax rate, applied to your taxable income. Understanding what constitutes taxable income is crucial for optimizing your "salary after taxes Michigan."

Deductions and Credits to Reduce Your Taxable Income

Reducing your taxable income is the most direct way to increase your "salary after taxes Michigan." Both federal and state levels offer several deductions and credits.

Federal Deductions

-

Standard Deduction vs. Itemized Deductions: Decide whether to take the standard deduction (a fixed amount based on your filing status) or itemize deductions. Itemizing may be beneficial if your itemized deductions exceed the standard deduction. Common itemized deductions include:

- Medical expenses exceeding 7.5% of your adjusted gross income (AGI).

- State and local taxes (SALT) – capped at $10,000 total for federal purposes. This includes Michigan income tax paid.

- Mortgage interest.

- Charitable contributions.

-

Retirement Contributions: Contributions to traditional 401(k)s or IRAs are generally tax-deductible, lowering your current taxable income. Consider maximizing your contributions to these accounts.

-

Health Savings Account (HSA) Contributions: If you have a high-deductible health plan, contributions to an HSA are tax-deductible. These contributions grow tax-free, and withdrawals for qualified medical expenses are also tax-free.

Michigan Deductions and Credits

Michigan offers a more limited set of deductions and credits compared to the federal government, but they are still valuable for maximizing your "salary after taxes Michigan."

-

Personal and Dependent Exemptions: Michigan allows a personal exemption for yourself and each dependent. This reduces your taxable income. The exemption amount is subject to change, so verify the current year's amount.

-

Michigan Homestead Property Tax Credit: If you own or rent a home in Michigan, you may be eligible for the Homestead Property Tax Credit. This credit reduces your state income tax liability and is based on your household income and property taxes paid.

-

City Income Tax Credit: Residents of certain Michigan cities (e.g., Detroit) pay city income tax. A credit may be available on your Michigan state income tax return to offset the city income tax paid.

-

Michigan Earned Income Tax Credit (EITC): Michigan offers its own EITC, which is a percentage of the federal EITC. Eligibility is based on income and family size.

Strategies for Tax-Efficient Financial Planning

Beyond deductions and credits, smart financial planning can significantly increase your "salary after taxes Michigan."

Retirement Planning

-

Maximize Retirement Contributions: As mentioned earlier, contributing to tax-advantaged retirement accounts reduces your current taxable income. It also allows your investments to grow tax-deferred (or tax-free in the case of Roth accounts).

-

Roth vs. Traditional Accounts: Understand the differences between Roth and traditional retirement accounts. Roth accounts offer tax-free withdrawals in retirement, while traditional accounts offer tax deductions now. The best choice depends on your current and future tax bracket.

Investing Strategies

-

Tax-Loss Harvesting: This involves selling losing investments to offset capital gains taxes. This strategy can reduce your overall tax liability.

-

Utilizing Tax-Advantaged Accounts: Beyond retirement accounts, consider utilizing 529 plans for education savings or health savings accounts (HSAs) for healthcare expenses.

Healthcare Choices

- Flexible Spending Accounts (FSAs): If your employer offers an FSA, you can contribute pre-tax dollars to pay for qualified medical expenses. This reduces your taxable income and can save you money on healthcare.

- Choosing the Right Health Insurance Plan: Carefully consider the costs (premiums, deductibles, copays) of different health insurance plans to ensure you choose the plan that is most cost-effective for your needs.

Regularly Review and Adjust

Tax laws and your financial situation can change. It's important to regularly review your tax situation and adjust your strategies accordingly to continue maximizing your "salary after taxes Michigan." Consider consulting with a qualified tax professional for personalized advice.

Video: Maximize Your Michigan Salary After Taxes: Secrets Revealed!

Frequently Asked Questions About Maximizing Your Michigan Salary After Taxes

This FAQ aims to answer common questions regarding optimizing your financial situation in Michigan, so you can keep more of your hard-earned money. We'll cover key areas to help you boost your salary after taxes in Michigan.

What are the main deductions that affect my salary after taxes in Michigan?

The biggest factors impacting your salary after taxes in Michigan include federal income tax, Michigan state income tax, Social Security, and Medicare. Contributions to pre-tax retirement accounts and health insurance premiums also significantly lower your taxable income, leading to a higher salary after taxes Michigan.

How can I legally reduce my Michigan state income tax burden?

You can reduce your Michigan state income tax burden by maximizing deductions, such as contributions to 529 college savings plans (if applicable) and eligible deductions or credits on your Michigan tax form. Carefully reviewing your eligibility for these benefits can increase your overall salary after taxes Michigan.

What's the impact of retirement contributions on my salary after taxes?

Contributing to a 401(k) or Traditional IRA reduces your current taxable income. This lowers the amount of tax you pay now, increasing your immediate salary after taxes. While you'll pay taxes on withdrawals in retirement, this strategy offers tax-deferred growth and can be a smart long-term move.

Are there any tax credits available for Michigan residents that can boost my salary after taxes?

Michigan offers several tax credits, including the Homestead Property Tax Credit (for homeowners) and the Earned Income Tax Credit (for lower-income earners). Explore available credits through the Michigan Department of Treasury. Claiming all eligible credits improves your salary after taxes Michigan.